What Is Put Option Selling

Put option selling is a low-risk investment strategy that allows investors to generate income and hedge against potential losses. Put option selling is a type of options strategy that involves selling put options contracts to another investor.

This gives the holder the right to sell an underlying asset at a specific price before a predetermined expiration date. You can even search online for more information about put option sell.

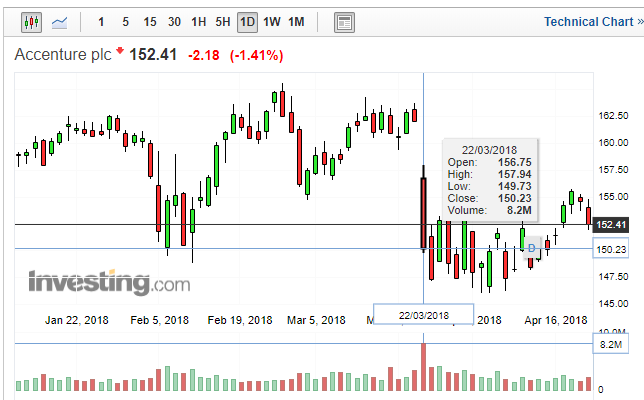

Image Source: Google

It is a popular strategy among investors looking to generate income, hedge against losses, or speculate on a stock's short-term direction. When an investor sells a put option, they are essentially that the stock price will remain above the strike price (the price at which they sold the option) until the expiration date.

If the stock price drops below the strike price, the investor will be obligated to buy the stock at the strike price and may incur a loss. When done correctly, put-option selling can be a low-risk investment strategy.

This is because the investor can set the strike price at a level below the current market price of the stock. This means that if the stock price drops, the investor will not incur a loss as long as it remains above the strike price.

Additionally, the investor will receive a premium from the buyer of the option, which provides a source of income and helps to offset potential losses. For investors looking to employ put option selling, there are several factors to consider.